Average Tax Savings With vs. Without Tax Planning

Businesses that engage in proactive tax planning save an average of 15% to 25% more annually compared to those who only file taxes.

(Source: IRS & NAEA reports)

What Happens When You Work with Skyline

This is more than a graph — it’s a clear story of transformation.

Most people think tax planning is just about filing forms. But the real difference comes from strategy.

Here’s what the data shows:

Doing it alone leads to the highest tax burden — overpaying by tens of thousands, plus risking audits and missing key opportunities.

Filing-only support reduces your total cost, but still leaves value on the table.

Skyline's full tax planning delivers the biggest return: lower taxes, no missed savings, fewer errors, and more control over your money.

When our clients combine tax filing with strategic planning, they don’t just “comply” — they optimize. The result? Over $40,000 in average savings, better cash flow, and peace of mind.

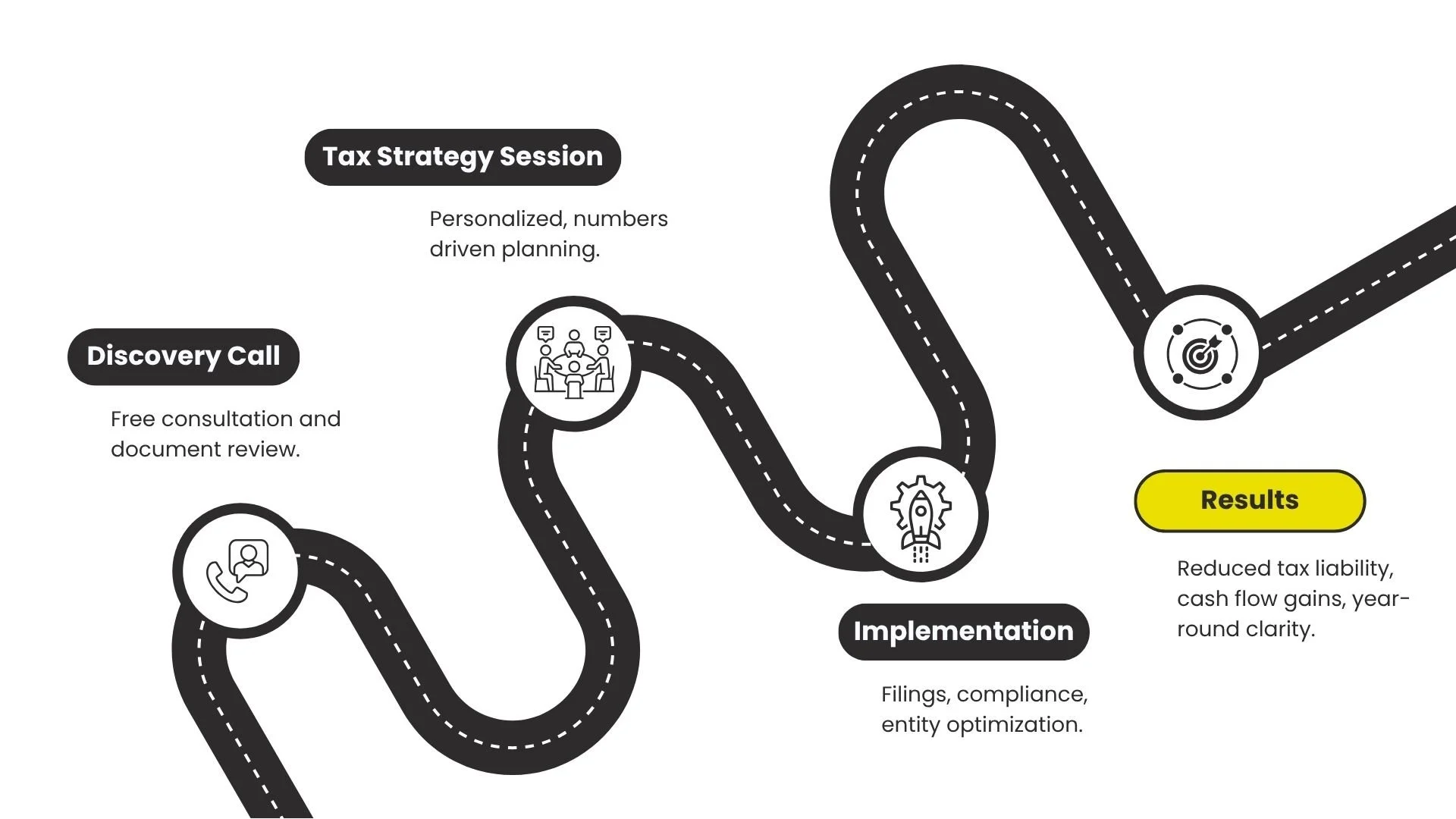

Your Journey with Skyline:

At Skyline CPA, we don’t believe in one-size-fits-all tax services. Every client journey begins with a thoughtful discovery call — where we listen, review, and identify hidden risks or missed opportunities.

From there, we build a personalized tax strategy that goes far beyond filing deadlines.

Through intentional planning, expert implementation, and ongoing support, we help our clients unlock real financial advantages: reduced tax liability, increased cash flow, and peace of mind year-round.

This isn’t just compliance — it’s clarity, control, and strategy designed to grow with you.